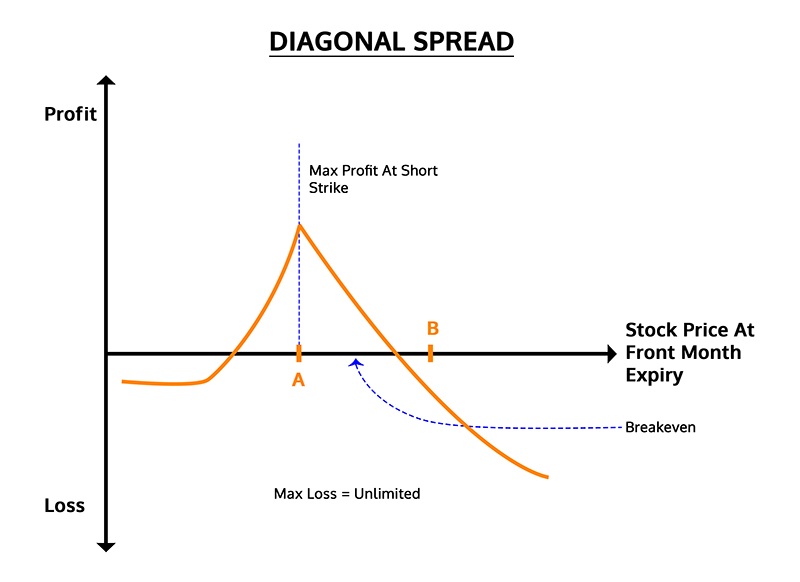

Diagonal Calendar Spread - Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different strike prices and expiration dates. Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. Web when to use a calendar spread vs. 1) when in doubt, adjust. Web if two different strike prices are used for each month, it is known as a diagonal spread. Web the short diagonal calendar call spread makes a smaller profit when the underlying stock breaks out upwards. A horizontal spread (also called calendar spread or time. Web a call diagonal spread is a combination of a bear call credit spread and a call calendar spread. Web a diagonal with two calls is a call diagonal spread (see figure 1).

Case Study Goldman Sachs Double Calendar and Double Diagonal

Click the video below as we discuss these types of signals and how to apply them in our approach to advanced micro devices (ticker: A put diagonal spread has two puts. Web the short diagonal calendar call spread makes a smaller profit when the underlying stock breaks out upwards. Calendar spreads and diagonal spreads have many similarities but also some.

Diagonal Call Calendar Spread Smart Trading

Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. A diagonal spread has both different months and different strike prices. Web if two different strike prices are used for each month, it is known as a diagonal spread. 1) when in doubt, adjust. This spread aims to benefit from.

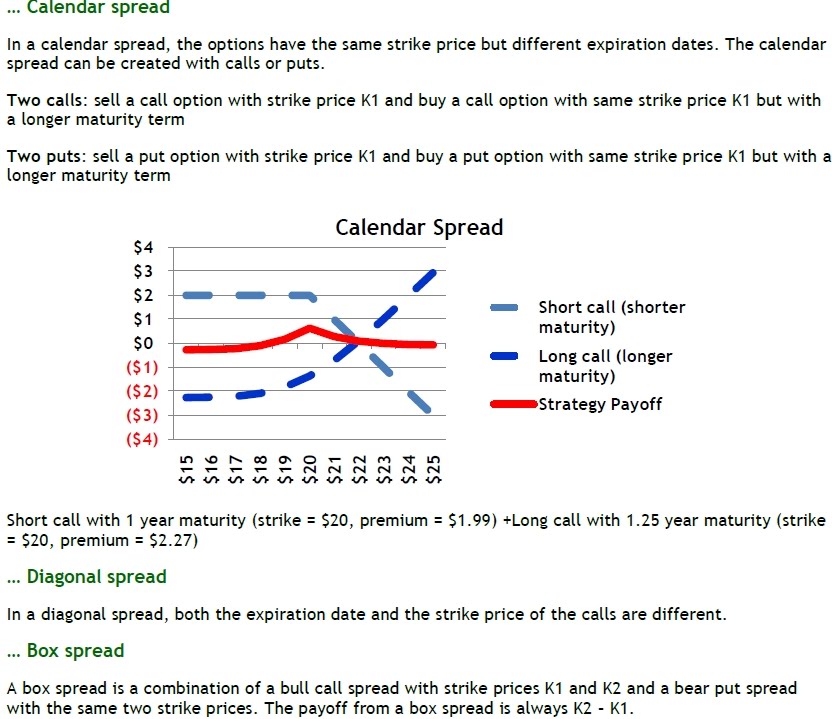

kthwow calendar spread, diagonal spread, box spread

Web when to use a calendar spread vs. Web since a calendar or diagonal spans different expirations, you'll need to build the trade manually when employing a calendar or. A diagonal spread has both different months and different strike prices. Web the following rules should be adhered to when using the calendar/diagonal spread strategy: Buy 1 out of the money.

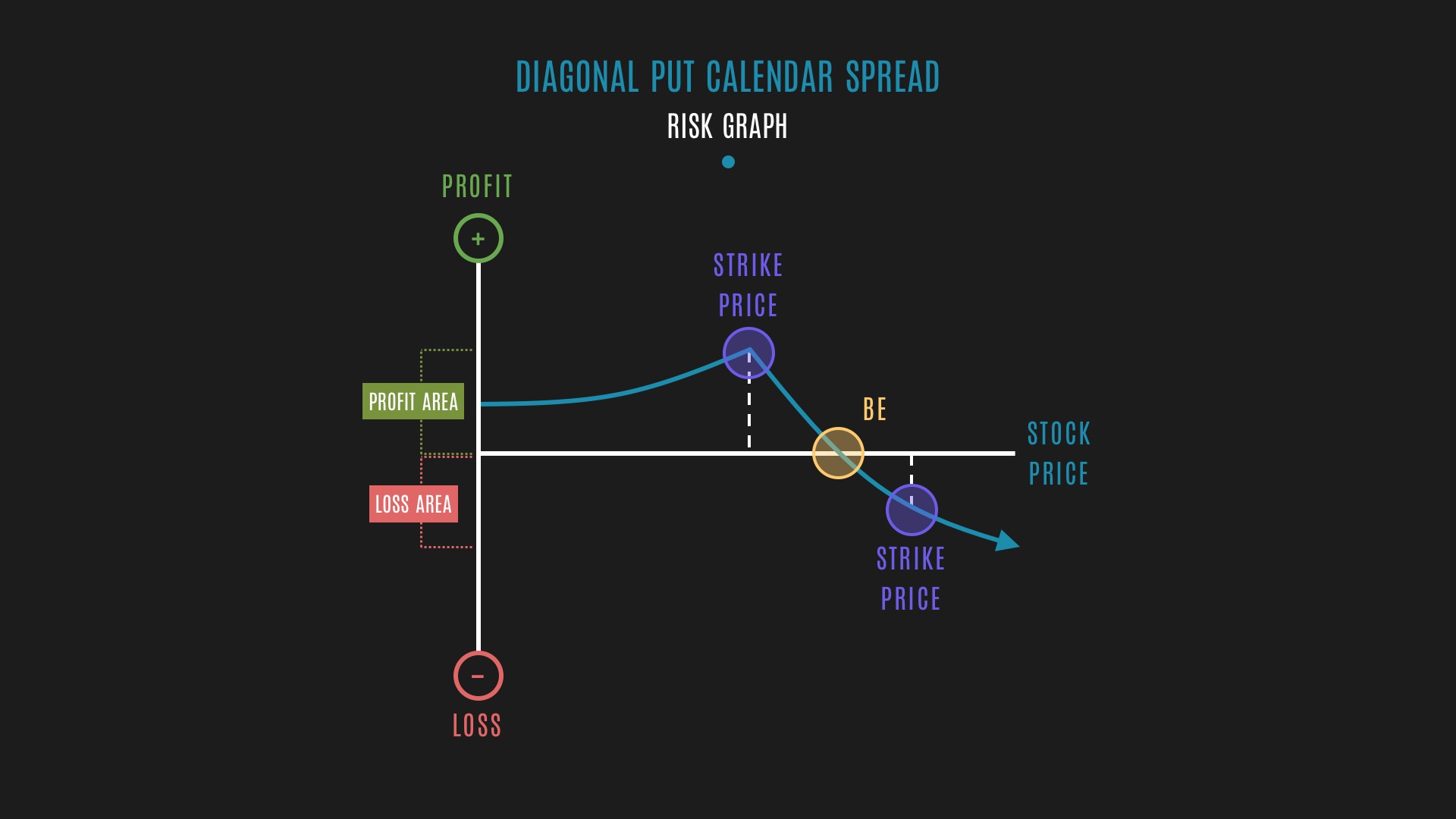

Glossary Diagonal Put Calendar Spread example Tackle Trading

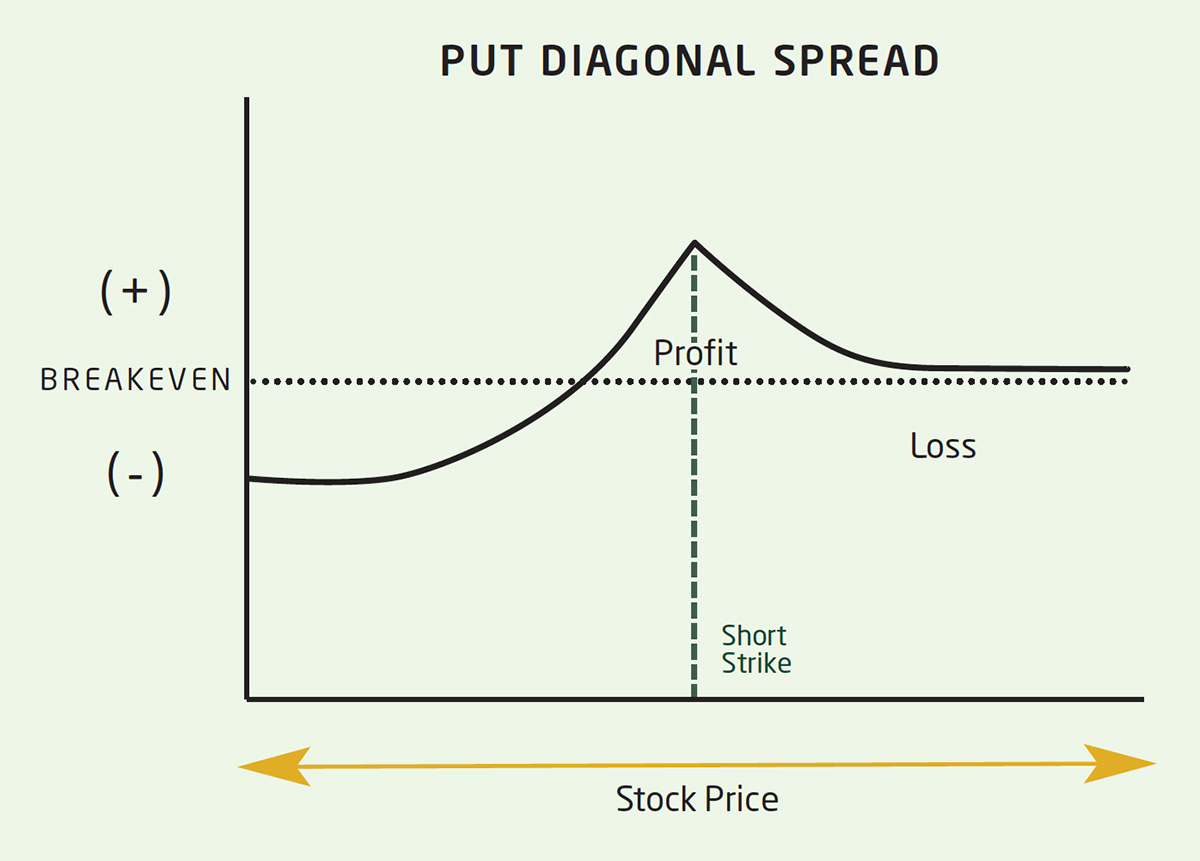

A put diagonal spread has two puts. Web the short diagonal calendar call spread makes a smaller profit when the underlying stock breaks out upwards. This spread aims to benefit from the advantages of both vertical and calendar spreads. Click the video below as we discuss these types of signals and how to apply them in our approach to advanced.

Special Focus Spread Trading // Building a Better Mo... Ticker Tape

Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. Web a call diagonal spread is a combination of a bear call credit spread and a call calendar spread. A horizontal spread (also called calendar spread or time. It’s a cross between a.

Diagonal Spread Options Trading Strategy In Python

A horizontal spread (also called calendar spread or time. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the. A diagonal spread has both different months and different strike prices. It’s a cross between a long calendar spread with calls and a short call spread. Web a diagonal.

Pin on Double Calendar Spreads and Adjustments

Web it is referred to as a diagonal spread because it combines two spreads: Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the. Web the diagonal spread.

Pin on CALENDAR SPREADS OPTIONS

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Calendar spreads and diagonal spreads have many similarities but also some important differences. A horizontal spread (also called calendar spread or time. This spread aims to benefit from the advantages of both vertical and calendar spreads. Web a diagonal.

Glossary Archive Tackle Trading

Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. It’s a cross between a long calendar spread with calls and a short call spread. Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes.

Calendar Diagonal Option Spread [Why FB]? YouTube

Sell 1 out of the money front month call. Web the following rules should be adhered to when using the calendar/diagonal spread strategy: Calendar spreads and diagonal spreads have many similarities but also some important differences. Web since a calendar or diagonal spans different expirations, you'll need to build the trade manually when employing a calendar or. Web a diagonal.

A horizontal spread (also called calendar spread or time. A put diagonal spread has two puts. Buy 1 out of the money back month call, at a higher month strike price. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the. Web if two different strike prices are used for each month, it is known as a diagonal spread. Sell 1 out of the money front month call. Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options. Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits when the underlying stock. Web a call diagonal spread is a combination of a bear call credit spread and a call calendar spread. Web a diagonal with two calls is a call diagonal spread (see figure 1). Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different strike prices and expiration dates. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. Web it is referred to as a diagonal spread because it combines two spreads: This spread aims to benefit from the advantages of both vertical and calendar spreads. Click the video below as we discuss these types of signals and how to apply them in our approach to advanced micro devices (ticker: It’s a cross between a long calendar spread with calls and a short call spread. Web since a calendar or diagonal spans different expirations, you'll need to build the trade manually when employing a calendar or. Web the following rules should be adhered to when using the calendar/diagonal spread strategy: Web a diagonal calendar spread (or a calendar diagonal spread) which constitutes an option trading strategy.

A Diagonal Spread Has Both Different Months And Different Strike Prices.

Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different strike prices and expiration dates. Click the video below as we discuss these types of signals and how to apply them in our approach to advanced micro devices (ticker: Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options.

Buy 1 Out Of The Money Back Month Call, At A Higher Month Strike Price.

A horizontal spread (also called calendar spread or time. Calendar spreads and diagonal spreads have many similarities but also some important differences. Web when to use a calendar spread vs. Web a diagonal with two calls is a call diagonal spread (see figure 1).

It’s A Cross Between A Long Calendar Spread With Calls And A Short Call Spread.

Web if two different strike prices are used for each month, it is known as a diagonal spread. 1) when in doubt, adjust. This spread aims to benefit from the advantages of both vertical and calendar spreads. Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different.

Web (April 2020) In Finance, A Calendar Spread (Also Called A Time Spread Or Horizontal Spread) Is A Spread Trade Involving The.

Web the short diagonal calendar call spread makes a smaller profit when the underlying stock breaks out upwards. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a call diagonal spread is a combination of a bear call credit spread and a call calendar spread. Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits when the underlying stock.

![Calendar Diagonal Option Spread [Why FB]? YouTube](https://i.ytimg.com/vi/qjfTMDLcmew/maxresdefault.jpg)